Digital payments are revolutionizing agriculture, and blockchain technology is emerging as a game-changer for secure and transparent transactions. In South Africa, where smallholder farmers often face challenges with delayed payments, high transaction fees, and lack of financial inclusion, blockchain-powered mobile payments offer a promising solution. By leveraging decentralized and tamper-proof transactions, farmers can receive faster, more secure payments while improving trust across the agricultural supply chain.

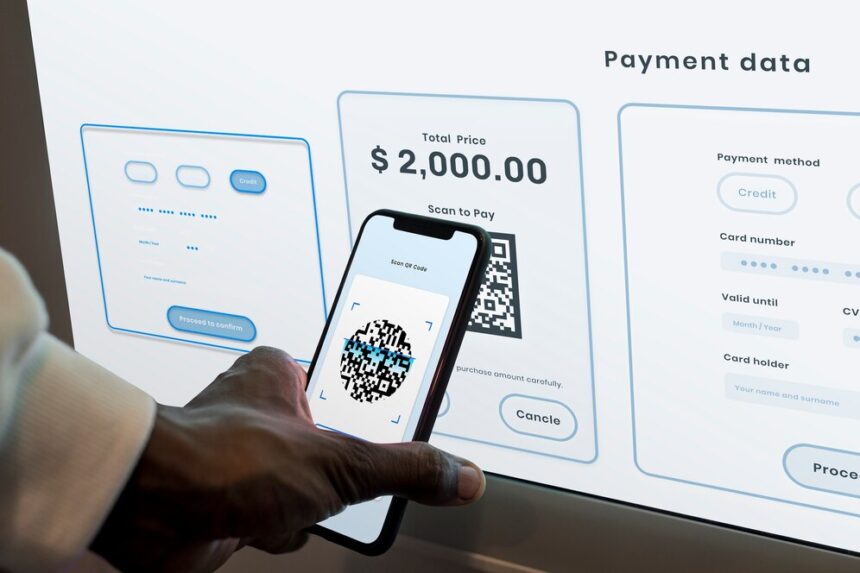

One of the biggest advantages of blockchain on mobile is instant and secure transactions. Traditional payment systems can take days to process, especially for farmers in rural areas who rely on intermediaries or bank transfers. Blockchain eliminates the need for third-party verification, allowing funds to be transferred directly between buyers and farmers. This ensures immediate access to payments, reducing financial strain and enabling farmers to reinvest in their operations quickly.

Another major benefit is transparency and traceability. With blockchain, every transaction is recorded on a decentralized ledger, making it impossible to alter or manipulate payment records. This is particularly important for South African farmers selling to large agribusinesses or international markets, where payment disputes and fraud are common. Blockchain ensures that all parties have a clear, verifiable record of transactions, reducing the risk of non-payment.

For smallholder farmers, lower transaction costs are another critical advantage. Many mobile money and banking services charge high fees for cross-border payments or transfers between different financial institutions. Blockchain-based mobile wallets allow farmers to bypass traditional banking fees, making transactions more affordable. This is especially beneficial for those who receive payments from export markets or work with multiple buyers.

Additionally, blockchain-enabled smart contracts can automate payments based on predefined conditions. For example, a smart contract can be programmed to release payment to a farmer once a buyer confirms delivery of produce. This eliminates delays caused by manual processing and reduces the need for intermediaries, ensuring that farmers are paid fairly and on time.

Access to microloans and insurance is also being transformed by blockchain technology. Many South African farmers struggle to secure loans due to a lack of formal credit history. Blockchain can create a secure financial profile based on transaction records, allowing lenders to assess creditworthiness more accurately. Similarly, insurance companies can use blockchain to provide instant payouts for climate-related losses, ensuring financial security during droughts or crop failures.

Despite its advantages, blockchain adoption in South Africa faces challenges such as internet connectivity issues, limited digital literacy among farmers, and regulatory uncertainties. However, with increasing smartphone penetration and growing interest in fintech solutions, blockchain-powered mobile payments have the potential to bridge financial gaps in agriculture.

By embracing blockchain for mobile transactions, South African farmers can benefit from secure, transparent, and cost-effective payments. As the agricultural sector continues to digitalize, blockchain will play a crucial role in ensuring financial stability, improving market access, and empowering farmers with financial independence.

Join 'Farmers Mag' WhatsApp Channel

Get the latest Farming news and tips delivered straight to your WhatsApp

CLICK HERE TO JOIN